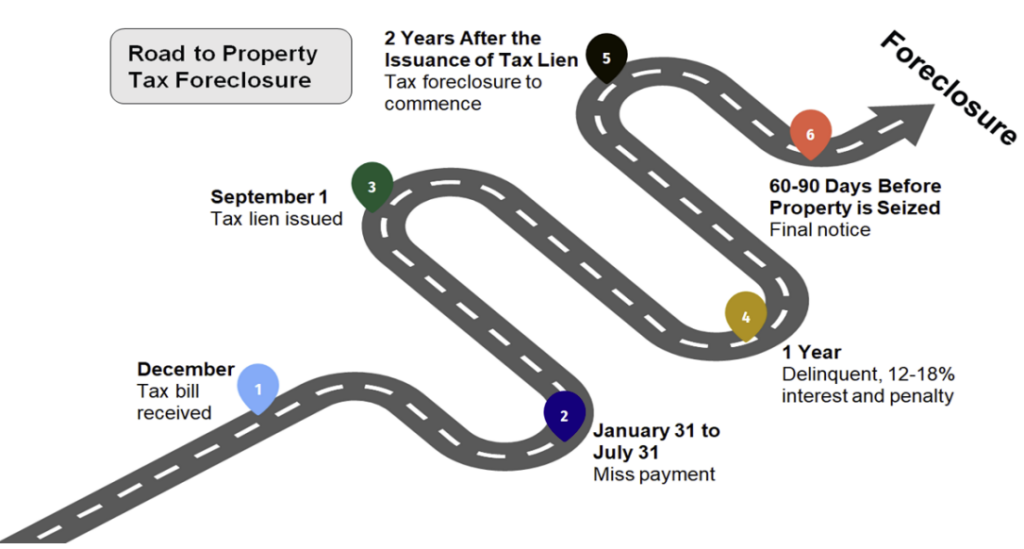

If you miss paying your property taxes by the due date you will begin to see penalties and interest accrued. It varies by county but minimally is 12%. Even if you miss your payment, you can still send money to your Treasurer. Continue to send as much as you can each month.

State Statutes

74.47 Interest and penalty on delinquent amounts.

(1) INTEREST. The interest rate on delinquent general property taxes, special charges, special assessments and special taxes included in the tax roll for collection is one percent per month or fraction of a month.

(2) PENALTY ALLOWED.

(a) Any county board and the common council of any city authorized to act under s. 74.87(link is external) may by ordinance impose a penalty of up to 0.5% per month or fraction of a month, in addition to the interest under sub. (1)(link is external), on any delinquent general property taxes, special assessments, special charges and special taxes included in the tax roll.

WHEDA property tax deferral program:

Property Tax Deferral Loan Program, WHEDA

PO Box 1728, Madison, WI 53701-1728

(800) 755-7835

If you still need help understanding programs available or help applying for any of these programs reach out to our Housing counselor from our HELP tab. We are happy to answer any questions!